BBG Holding I LP

$0.00

Offering Description

Offering Terms

NOTE: You will need your Bank Account Number, Transit Number, and Institution Number to Invest.

This offering is for Accredited Investors Only

Investment Term: 2-5 Years

Securities: LP Units

Minimum Subsctiption Amount: CAD $25,000

Subscription Price: CAD $10.00 per Unit

Offering Size: up to $450,000

Please note these outlined returns and distributions are targets only, and the General Partner makes no assurances that the partnership will meet these targets.

This is a shortened summary of the investment offering, and does not contain all details. Please review the Limited Partnership Agreement and Declaration of Limited Partnership in detail prior to investing.

Forward Looking Statements Disclosure

The information contained within this offering page and related presentations constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) sources, availability, and the use of proceeds from third-party financing for the Company’s projects; (iii) the expected development of the Company’s business, projects, and partnerships; (iv) execution of the Company’s vision and growth strategy; and (v) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements should not be taken as guarantees of future performance, and undue reliance should not be placed upon them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Please review the Issuer’s Business and Risks sections of the Offering Document or Offering Memorandum if available for full explanations of the material factors, assumptions used and risks.

The forward-looking statements have been approved by management as of the launch date of this offering.

FAQs

What is the Blue Bear Group (BBG) Corp. investment strategy?

BBG Corp. focuses on transforming Canadian multifamily real estate by developing and acquiring high-quality, ecologically responsible, and attainably priced rental properties. Their strategy targets sustainable, tech-integrated properties in Canada's most rapidly expanding urban centers, aligning profit with positive impact.

What is the mission of BBG Corp.?

The mission is to maximize the value of multi-family real estate for investors. This is achieved by optimizing every aspect of property ownership and management to transform properties into high-performing assets that generate competitive returns and build long-term value.

What does BBG Corp. offer to investors?

BBG Corp. offers several key benefits:

- Long-Term Wealth Generation in Canada's robust multifamily market.

- Exceptional Real Estate Management to optimize property performance and asset value.

- Stable Cash Flow from meticulously managed rental portfolios.

- Global Investment Opportunities for both Canadian and international investors.

What specific property is this investment for?

This offering is for "The 311 de la Grande-Côte I", a multifamily property located in Saint-Eustache, a desirable suburb of Montreal.

Why invest in Saint-Eustache (Montreal North Shore)?

The Montreal North Shore is a "demand-driven location"13. It is an ideal environment for mid-class families, which translates into stable, high-quality tenancy. The region shows strong fundamentals, including:

- Population Growth: A steady increase in population

- Income Growth: Rising median household incomes

- Safety: Low crime levels (rated B+)

- Economic Health: A strong and rising employment rate

- Rent Trends: Local apartment rents are competitive and stable.

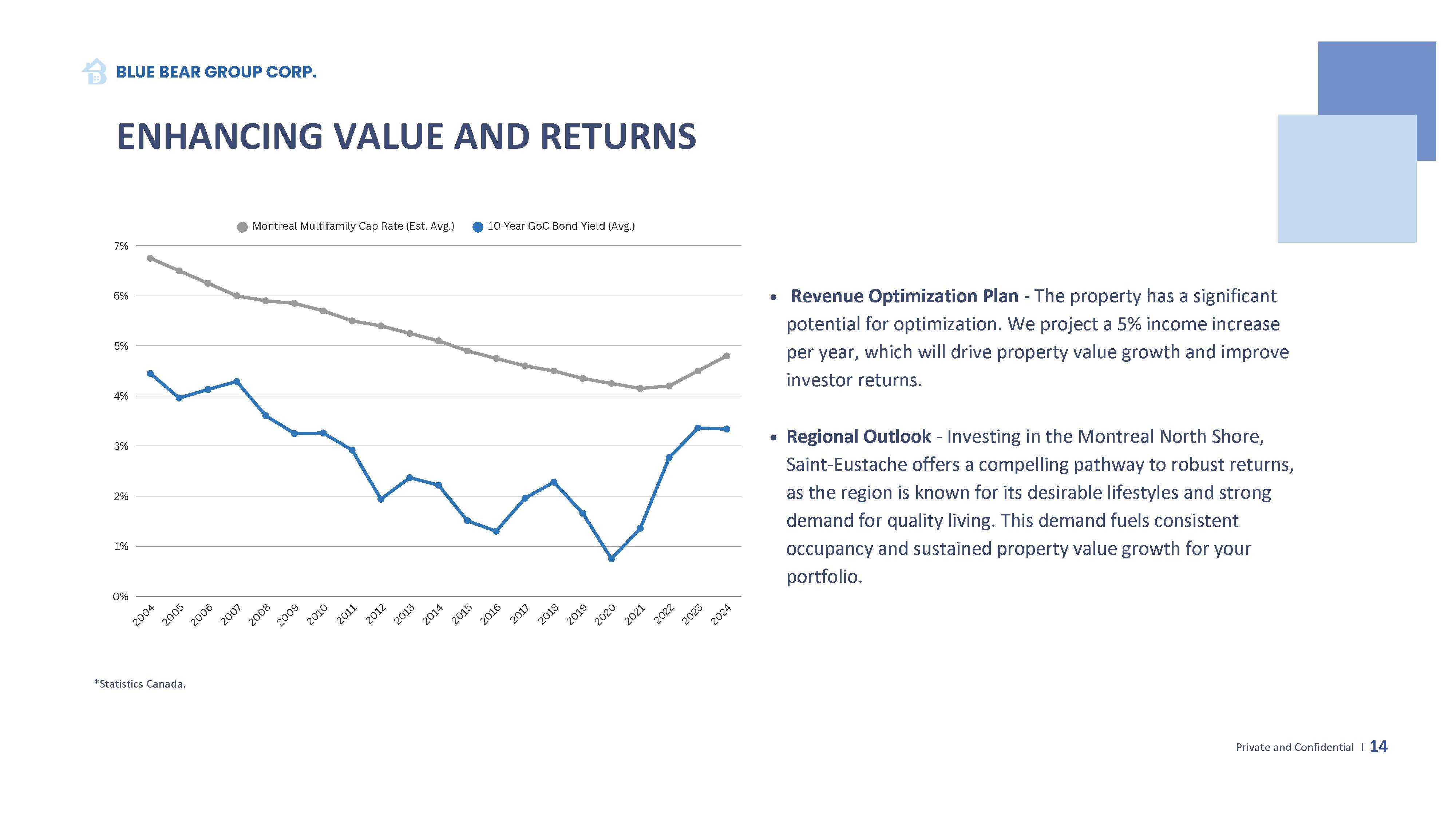

What are the target returns for this project?

The strategy is designed to achieve a targeted 9-12% annual return (Total Project IRR) over a 5-year period. This accounts for all projected income and the property's increased value, magnified by the use of leverage.

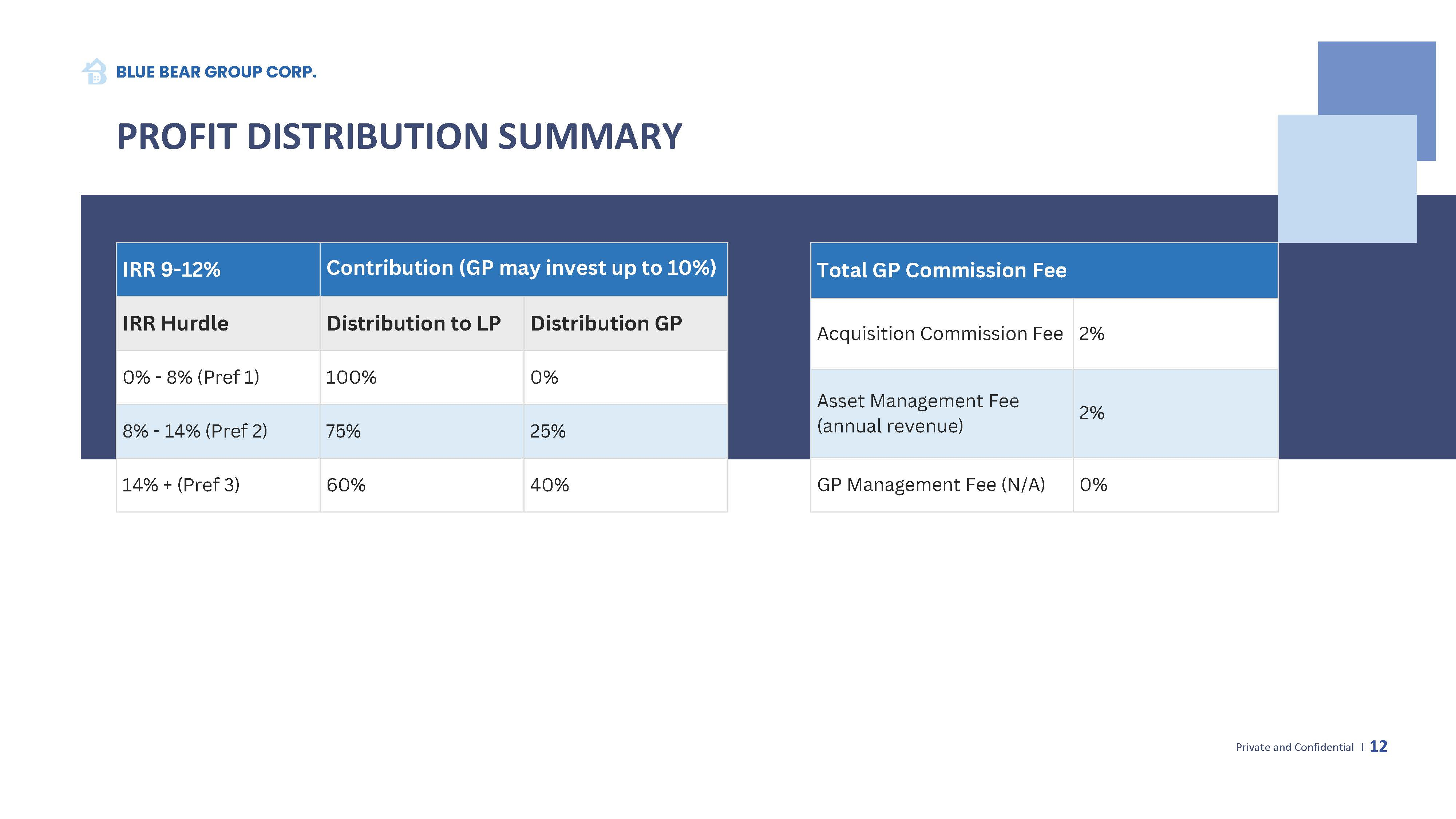

How is profit distributed to investors (Limited Partners)?

Distributions follow a "waterfall" structure that is tiered to favor you, the Limited Partner (LP), until high return hurdles are met:

- Return of Capital First: You are the first to receive cash distributions until you get back 100% of your initial Capital Contribution.

- Preferred Returns (IRR Hurdles): After your capital is returned, profits are split to meet performance targets:

- Tier 1 (Up to 8% IRR): You receive 100% of remaining cash until you reach an 8% per annum Internal Rate of Return (IRR)

- Tier 2 (8% to 14% IRR): You receive 75% of remaining cash until you reach a 14% per annum IRR

- Tier 3 (Beyond 14% IRR): You receive 60% of all remaining cash after the 14% IRR threshold is met.

What are the key management fees?

All fees are clearly defined in the profit distribution summary:

- One-Time Acquisition Fee: 2% of the total purchase price of the property.

- Annual Asset Management Fee: 2% of the gross rental income.

Is my personal liability limited as an investor?

Yes. As a Limited Partner in this structure, your liability for the Partnership's debts and obligations is strictly limited to the amount of your Capital Contribution. You will not be liable for any further claims or assessments.

Can the General Partner (BBG Corp.) ask me for more money later?

No. You are not required to contribute any further amounts to the Partnership beyond your initial Capital Contribution.

Who is responsible for the Partnership's debt?

The General Partner (GP) has unlimited liability for the debts, liabilities, and obligations of the Partnership. This is a key feature of the GP/LP structure.

What is the General Partner's standard of conduct?

The General Partner must exercise its power and duties honestly, in good faith, and in the best interests of the Partnership. They must use the degree of care, diligence, and skill that an ordinary prudent person would use when dealing with another person's property.

Who is qualified to invest in this offering?

To invest, Canadian securities regulations require you to qualify as an "Accredited Investor". An individual qualifies by meeting at least one of the following criteria:

- Income Test: A net income before taxes exceeding $200,000 in each of the last two years (or $300,000 combined with a spouse) and a reasonable expectation to exceed that level in the current year; OR

- Financial Asset Test: Beneficially own, alone or with a spouse, financial assets (cash, securities, etc.) with an aggregate realizable value (before taxes, net of liabilities) exceeding $1,000,000; OR

- Net Asset Test: Have, alone or with a spouse, net assets of at least $5,000,000.

What are the next steps to invest?

There is a simple three-step process:

- Connect with BBG Corp.

- Sign-up on the Equivesto platform and get approved as an Accredited Investor (AI).

- Invest and send your funds.