Hutsy Financial

$80,697.00

Offering Description

The Revolution of the Financial Industry

Hutsy is a neo-bank that plans to offer prepaid, reloadable cards as well as an integrated application that gives clients real-time insights into their spending. Hutsy is in talks with DC Bank about a partnership to offer these prepaid cards. Where we differentiate ourselves is by using the latest technology to provide tools and resources for our clients such as an option of a free credit score for our users to improve their credit with monitoring and reporting. As well as investment options to get more Canadians saving and investing. It’s important to note we are not a bank, we are a neobank that sits overtop of a traditional banking infrastructure and provides enhanced experiences for our consumers.

According to Waldsdorf et al and Invest Executive, 45% of Canadians are living paycheque to paycheque which results in about 3 million adults using payday lending services each year. If you don’t know already, payday lenders charge APR’s well over 400%. In a recent article, Vice reported that payday lenders are charging up to 780% interest since COVID-19 started. Although it seems obvious that people should avoid payday lenders altogether, the unfortunate reality is that it’s not that easy to get access to other options, like overdraft. One of the features we have added to put an end to predatory lending is our early access to payroll that our users will be able to access as long as they have a direct deposit payroll going into Hutsy.

On the other hand, we want to incentivize Canadians to save. According to Benefits Canada, 56% of Canadians over 50 don’t have a retirement savings plan. This is very concerning to us at Hutsy. One of the features that we are looking to create with Hutsy is a roundup program that rounds spare change up on all purchases and automatically invests it into the stock market. We have a few potential companies that we are in discussions with, in order to make this happen.

Pitch Deck

Highlights

- Over 5000 people on our waitlist to become users of Hutsy.

- Hutsy has experimented with lending and has successfully made a 107% return on investment.

- According to Global Newswire, the Neo and challenger bank market was valued at $20.46 billion in 2019 and is projected to reach $471.06 billion by 2027 (Canada and USA).

- Hutsy will now directly challenge the payday lending industry by providing users with access to early payroll so Canadians can avoid going to loan sharks.

Perks

- First year FREE for premium users.

- Optional share buyback program 10% return annually on your investment.

- No investment management fees on investments for Hutsy Investors.

Core Values

Hutsy's core values consist of ensuring the financial well-being of Canadians by forming key partnerships with other FinTech companies to join forces and create faster, safer, better financial products for our clients. Five banks hold 95% of assets in Canada and Canadian banks are some of the most profitable banks in the world per capita. However, according to Invest Executive, 45% of Canadians live paycheque to paycheque and as consumers we have nothing to show for banks bringing in billions of dollars annually. It is almost like banks are “disincentivized” to provide products that help Canadians as it will eat into their profit margins. Core values at Hutsy are built around creating a bank with great rates and no monthly fees, which uses smart technology to show the most relevant information about your spending, saving and bills, so you can plan forward, as well as look backward. We’re stripping the waste out of the traditional banking industry to give back to customers and challenging the status quo of what banking is and how it’s done. We’ve found the best and brightest in banking and technology and liberated them to create the bank they’ve always dreamed of, with smarter technology and experiences that people have come to expect in a world run on your mobile devices.

We want to target people and provide them with the education and resources they need to make better financial decisions that will help them save money, make money, and borrow money when in need. Big financial institutions leave a lot of cracks in the ground for startups to dominate as it is not that profitable for them to operate in that market.

With help, support and Tefari’s ability to empower the core management team for Hutsy, CEO and Founder Tefari Bailey will bring these core values to life.

Revenue Model

How does Hutsy make money?

Hutsy’s business model is designed to make monthly payments from various service fees, keeping fees low and simple for users while optimizing for profitability. We make money on annual card fees, interchange fees (when a customer makes a purchase), and loan brokerage fees.

For premium card users they are charged $10 monthly or $100 annually if they pay upfront. Normal financial institutions charge up to $30 a month or $360 annually for a premium account. Please see our total revenue breakdown below.

Premium Card Fees

$100 annually or $10 monthly ($120 annually)

Interchange Fees 1.5% of all purchases. For example, if someone spends $300 monthly on their Hutsy card, Hutsy makes $4.50 monthly, which would be $54 annually. With 5,000 users that would be $270K from this revenue stream alone. (We currently have 5000+ users on our waitlist)

Loan Fees

In the future, we plan on being the middleman with our white labelled lending platform and charging 4% of the funded loan amount to the borrower. For example, if someone is looking for a $5000 debt consolidation loan and our partner is able to fund this loan, we will charge a 4% commission on the loan which would be $200 for Hutsy. We are currently in advanced talks with a few potential lenders that specialize in debt consolidation loans.

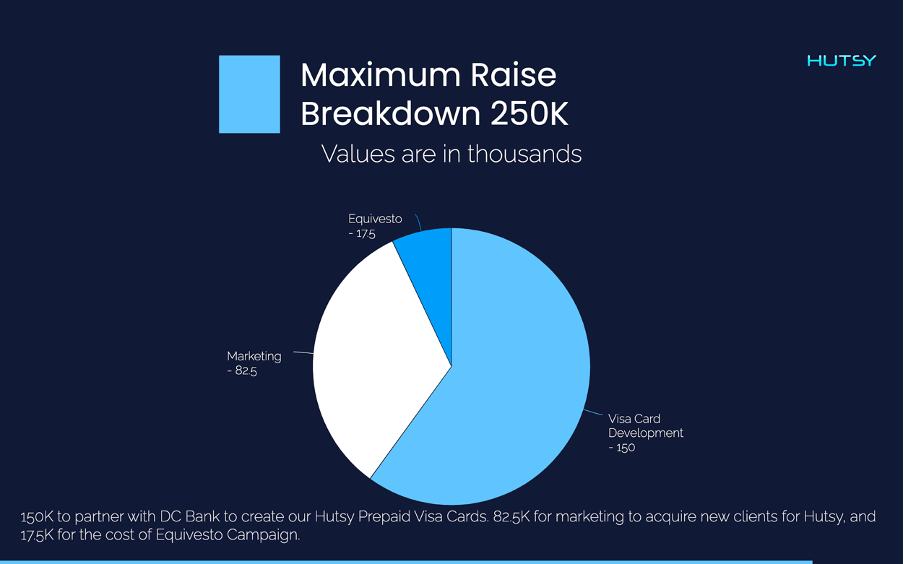

Raise Amount

Hutsy Financial. Legal name (Hutsy Financial Corp.) is raising $250,000 with a pre money valuation of $5,000,000 and a post money valuation (after the investment is received) of $5,250,000 assuming a $250,000 raise.

With 10,000,000 total shares outstanding (issued so far by the company), Class A Non-Voting, Common Shares will be issued at a price per share of $0.50.

Assuming the maximum raise, 4.8% of the business is being offered during this round. If the minimum is raised ($25,000), that equates to 0.05% of the business.

The shares will have rights to any potential dividends (payouts) from the company, and will have the right to share in any proceeds from the sale of the business. The shares have 'Tag Along' and 'Drag Along' rights to protect minority shareholders. The shares do not have the right to vote or have a say in the control of the business.

Traction

Use of Funds

Innovation

How Hutsy will Revolutionize the financial industry:

- Credit reporting in app

- Automated investment options

- Ending payday lending industry

- AI first approach

Innovating with Neo Thinking

Hutsy will revolutionize the financial Industry. As we will provide these solutions: credit monitoring and building, round ups, end payday lending, and we take an AI approach. Hutsy is innovating and revolutionizing the financial industry by providing digital or pre-paid, reloadable cards with a companion app to help you invest, save, and track your finances with ease. By leveraging AI, big data, and artificial intelligence we are able to make this happen.

Team

Competition

These companies have shown major success in this space. Our main target audience are the 45% of Canadians living paycheque to paycheque. Offering them financial tools, and solutions to get them out of those situations.

04/14/2021

Signed Term Sheet with Venture Capital Firm

Hutsy Financial has received an investment offer and signed Term Sheet from a US based Venture Capital firm for a $5,000,000 investment in Hutsy Financial. This Term Sheet is not binding and is subject to full Due Diligence on Hutsy Financial by the Venture Capital Firm.

If Due Diligence is completed and the investment moves forward, the valuation of Hutsy Financial as outlined on the Term Sheet is $15,000,000.

04/16/2021

Hutsy Financial Pre-Selected for Dragon's Den!

Hutsy Financial has been pre-selected to appear on an episode of Dragon's Den on CBC!

Dragon's Den is an entrepreneurial show where small business and startup owners pitch their idea to a group of savvy angel investors, who given the feedback and can offer investment.

Hutsy has not recorded an episode yet, and while a date of May has been offered, there are no confirmed details as to when the episode will be filmed, and if/when it will be selected to air. At this stage, it is still possible for the offer of participation to be rescinded. Participation on Dragon's Den does not guarantee an investment from any of the Dragons, and even what appears to be an investment on TV is subject to full due diligence, where either party may back out of the deal.

04/17/2021

Hutsy Financial Raise Extension

Given the larger demand of investors, Hutsy Financial has extended their equity crowdfunding campaign by one month. The campaign will remain open for investment until Hutsy reaches their maximum raise amount, or until the end of the day on May 19th, 2021.

Even though Hutsy is over 250% funded, investors can still participate and invest in Hutsy Financial until the close of the campaign!

05/07/2021

Hutsy Financial Closing Date Amended

Hutsy Financial has amended their campaign closing date from May 19, 2021 to May 14, 2021. Hutsy is over 289% funded and excited to close the campaign so they can begin the next stage of their growth and development (see previous updates for more details). Investors still have until May 14, 2021 to invest in Hutsy Financial.

05/18/2021

Hutsy Financial Campaign Closed - Over 325% Raised!

Hutsy Financial's campaign has closed with over 325% raised! Thank you to all the investors who came together to support Hutsy. Equivesto and Hutsy will now begin the 'closing' process, which takes 30 days. All investments made during the campaign are being finalized, after which the paperwork and legal filings will be completed.

Once the filings are completed, everyone who participated will officially become investors in Hutsy Financial, and the Hutsy Financial team will reach out directly to continue the relationship with each investor, and explain their next steps and how frequently investors can expect updates.

The investment documents signed when making the investment are your official legal documents and records, and the Hutsy team will update their legal records to record each investor as a shareholder. No further documentation or work is required from investors.

Please reach out to Equivesto or the Hutsy team if you have any questions.

FAQs

No Q&A have been posted for this campaign yet. Ask the project creator directly.