Maman Biomedical Inc.

$52,500.00

Offering Description

Special Purpose Vehicle Terms

NOTE: You will need your Bank Account Number, Transit Number, and Institution Number to Invest.

This investment is only open to all investors who a residents on Canada over the age of 18, excluding residents of Quebec.

To invest in Maman Biomedical Inc. you will be investing via a Special Purpose Vehicle (SPV) and not investing directly. You will NOT appear on the cap table of the underlying issuer.

What is a Special Purpose Vehicle (SPV)?

A Special Purpose Vehicle is a corporation or limited partnership formed for a specific purpose. In investing, a special purpose vehicle is typically used to allow smaller investors to pool their funds together in one company before then having that company invest in an underlying business. The purpose of the SPV is to allow the underlying business to have few investors on its cap table and to consolidate the management of multiple smaller investors outside the main company.

SPV Name: Maman Biomedical SPV LP

General Partner: 1001373206 Ontario Inc.

Managed by: Equivesto & Maman Biomedical Inc.

Additional fees for SPV: None

SPV will invest all funds received directly into Maman Biomedical Inc.

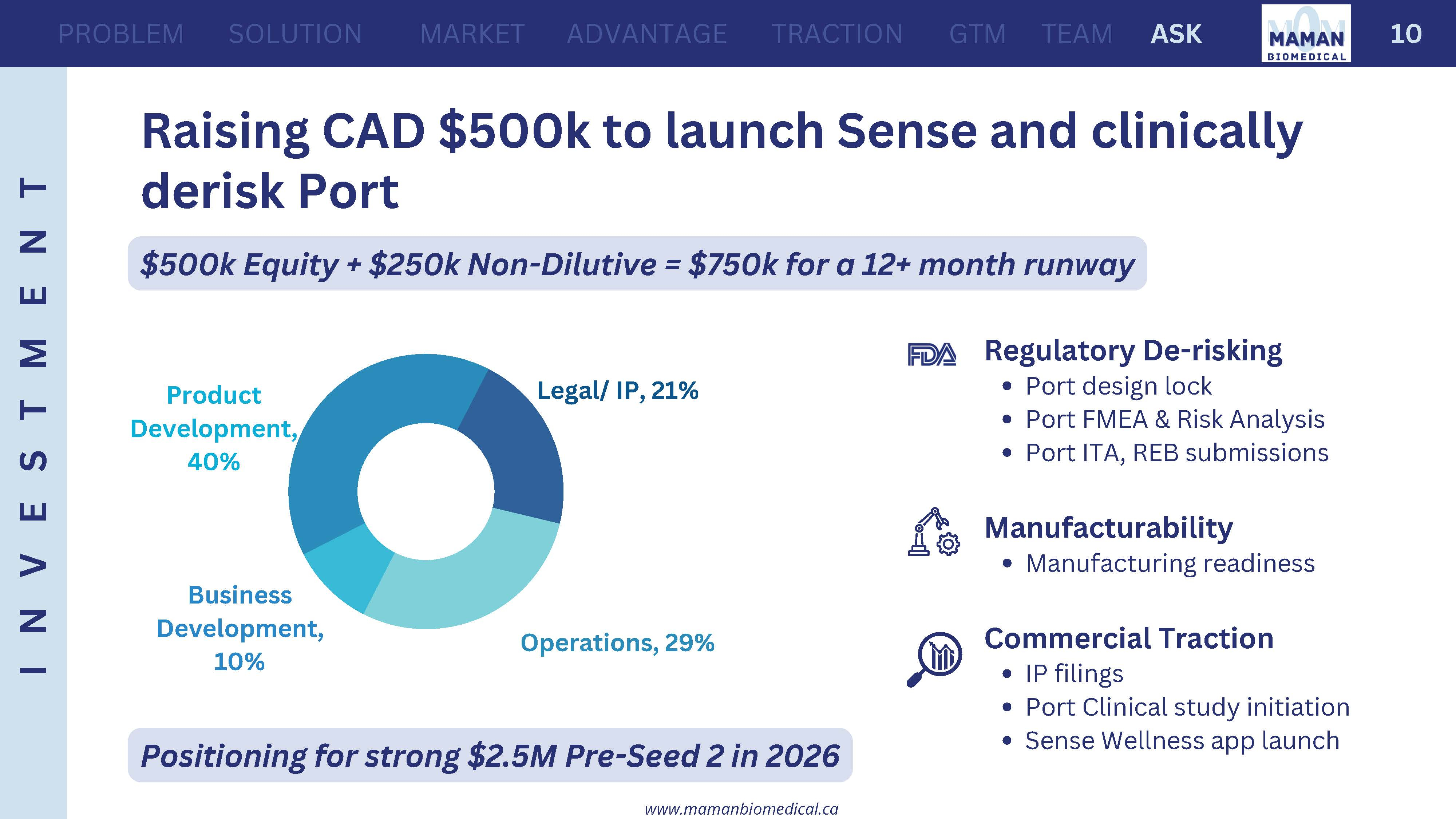

Minimum Raise: $50,000 for 50,000 Class B Units at $1.00 per Class B Unit

Target Raise: $500,000 for 500,000 Class B Units at $1.00 per Class B Unit.

Round Final Close: January 13, 2026 (the issuer may chose to close funds earlier than this date, and may have multiple closings).

Minimum investment amount: $500.00

Securities offered: Class B Units

Please see Limited Partnership Agreement for full details of the structure of the SPV and the rights of the units. Please see 45-110F1 Offering Document for full details and risks of this offering. You must create an account on Equivesto to view attached documents. Data Room available upon request.

Underlying Investment Offering Terms

NOTE: You will need your Bank Account Number, Transit Number, and Institution Number to Invest.

This investment is into Maman Biomedical Inc.

This investment is via a Convertible Note:

What is a Convertible Note?

A Convertible Note allows investors to invest funds at no fixed valuation, and instead have their investment convert into shares at a future investment date, where there will be a fixed valuation. The Convertible Note is debt, owned from the company to the investor, until the investment is coverted into shares. The Convertible Note agreement includes a Valuation Cap, so that no matter the valuation of the future round, the number of shares they are given will be based on the pre-set fixed valuation cap. To reward investors for investing earlier, investors will have a discount rate applied to their investment at the future valuation date, which further discounts the potential future valuation and rewards Convertible Note investors with more shares. If there is no future investment round, Convertible Note remains as debt and must be repaid by the company by the maturity date if it is not extended. The value of investment converted into shares as part of the conversion will include the interested earned since the signing of the Convertible Note, as interest is accrued but not paid out from the company as cash.

NB: Convertible Notes provided as investments into technology startups are not expected to be repaid as debt, even at the matiruty date, but expected to be extended and renegotiated. Using the convertible note structure is done to provide additional protections to investors and given them greated negotiating leverage, not to actually have the funds repaid as a loan.

Post-money valuation Cap (After investment received): CAD $7,000,000

Discount Rate: 20% (meaning your investment will convert at 80% of the value of the future valuation at the time of conversion). This means that the conversion valuation at the time of conversion will 20% less than the valuation for other investors.

Interest Rate: 6% per annum

Maturity Date: 5 years from execution of convertible note

Conversion Terms: Conversion will take place automatically, and would be triggered by a qualifying future equity capital raise into Maman Biomedical Inc. The Convertible Note will convert into the same class of share as the shares issued as part of the future capital raise.

Multiple Closings: This offering will have multiple closings, or at a date decided by the Issuer.

Securities offered: Convertible Note Units at $1.00 per Convertible Note Unit (Converting into Shares)

Please see 45-110F1 Offering Document and Articles of Incorporation for full details of rights associated with the Convertible Note. You must create an account on Equivesto to view attached documents.

Forward Looking Statements Disclosure

The information contained within this offering page and related presentations constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) sources, availability, and the use of proceeds from third-party financing for the Company’s projects; (iii) the expected development of the Company’s business, projects, and partnerships; (iv) execution of the Company’s vision and growth strategy; and (v) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements should not be taken as guarantees of future performance, and undue reliance should not be placed upon them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Please review the Issuer’s Business and Risks sections of the Offering Document or Offering Memorandum if available for full explanations of the material factors, assumptions used and risks.

The forward-looking statements have been approved by management as of the launch date of this offering.

12/30/2025

Update: Target Goal Adjustment

Maman Biomedical Inc. has made a material adjustment to the Minimum Offering Goal of it's Equity Crowdfunding round. The minimum raise goal has been lowered from $100,000 CAD to $50,000. As a result of this material change, all existing investors are granted a 48 window during which they can request a rescission/refund of their investment made prior to the change. Please contact invest@equivesto.com if you would like to request a rescission. A message from the management team of Maman Biomedical Inc. is included below.

--

Dear Maman Angels,

Happy holidays to you and yours.

I'm reaching out with some updates. We've decided to reduce our target close from $100k to $50k. With 14 days until the close of this leg of the campaign, we cannot increase the time to close, but we are certain that we can close the smaller gap in this time.

Our conversations with prospective investors continue to go well, and we're having significant interest to fill the round outside of the equity crowdfunding campaign.

If you have any questions or concerns about this change, please reach out to have a chat with us! In the meantime, I look forward to closing the round with you all in the next two weeks.

On another note, Maman will be celebrating our 2-year anniversary in January 2026, and this creates the perfect opportunity to meet our new angels and celebrate the close of the round. Please hold the date for Jan 28th.

Warmly,

Latchmi

_________

Latchmi Raghunanan, PhD

CEO & Founder

FAQs

No Q&A have been posted for this campaign yet. Ask the project creator directly.