Scott McGillivray Real Estate Fund

$14,400,000.00

Offering Description

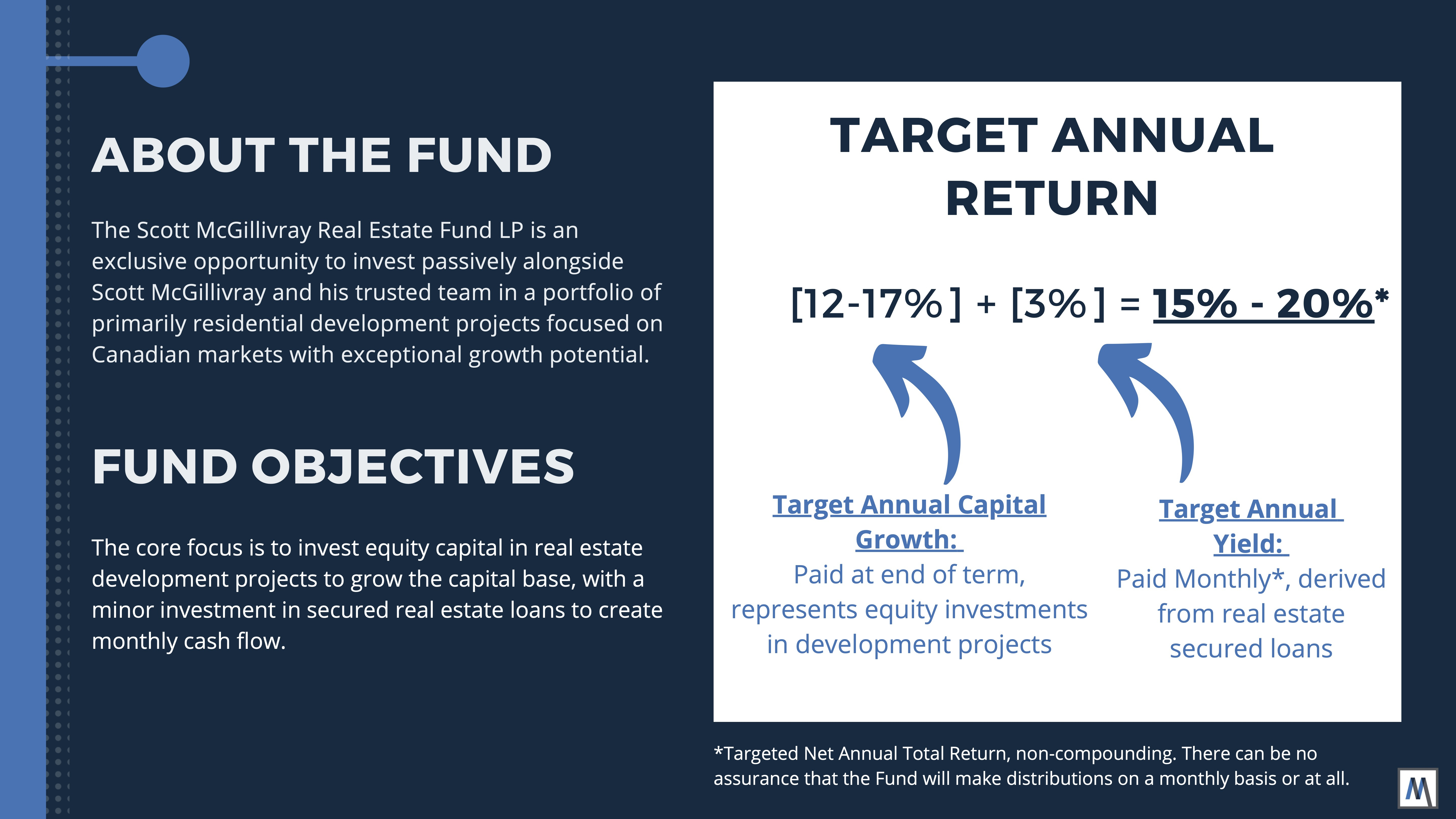

Target Annual Return 15%-20% (net)

The Scott McGillivray Real Estate Fund is an exclusive opportunity to invest passively alongside Scott McGillivray and his team in a portfolio of primarily residential development projects focused on key growth areas in key Canadian markets and earn an attractive return. Real estate investing with none of the hands-on work.

Simplicity Meets Profitability – Experience the Power of Passive Investing

Why Participate?

With 20+ years experience in real estate, Scott and his trusted team have built an extensive network of developers and investment industry experts, whom he brought together to structure this opportunity. With a deep understanding of market fundamentals, Scott and his team strategically source profitable off-market deals. This same team applies institutional-grade due diligence when selecting investments and only considers opportunities that are proven and trusted.

☑ Leverage Scott's team, expertise and network

☑ Rigorous due diligence

☑ Strategic sourcing

Who Should Invest?

This opportunity is ideal for investors who are passionate about real estate and interested in:

☑ Generating wealth through real estate development

☑ Earning a passive monthly income stream

☑ Investing passively in the Canadian real estate market

How Is It Different?

The Scott McGillivray Real Estate Fund offers investors multiple benefits including:

☑ Portfolio diversification - your investment is diversified over multiple projects and products vs. a single project or product category

☑ Returns consist of both regular monthly income payments + capital growth

☑ Proven and trusted investment team invests alongside you

Investment Terms

NOTE: You will need your Bank Account Number, Transit Number, and Institution Number to Invest.

This offering is for Accredited Investors and Eligible Investors Only

This Offering is TFSA/RRSP Eligible. PLEASE SPEAK TO EQUIVESTO before investing if you wish to invest via TFSA/RRSP.

Accredited Investors

can invest directly in the Scott McGillivray Real Estate Fund if investing in cash

Investment Term: 4 Year Closed-end Fund, Not Redeemable

Securities: Class A Limited Partnership Units

Eligible Investors

Eligible Investors and Eligible/Accredited Investors investing with funds held in Registered Accounts invest into Scott McGillivray Real Estate Trust.

The Trust plans to invest its funds into Scott McGillivray Real Estate Fund LP. The Trustees of the Trust are Andrew and Scott McGillivray

Investment Term: 4 Years Open Ended Mutual Fund Trust, Redeemable upon request, subject to fees and terms. See Offering Memorandum section 5.5 for details.

Securities: Class A Mutual Fund Trust Units

For Both Accredited & Eligible Investors

Minimum Subsctiption Amount: CAD $50,000

Subscription Price: CAD $1,000 per Unit

Offering Size: There is no maximum or minimum offering size.

Target Fund Size: CAD $14,500,000

Target Returns: The Partnership & Trust aim to make distributions monthly and has a target annual yield of 3%, with a target total return of 15%-20% per annum (net). Investors in the Trust may have slightly lower returns to cover the costs related to the trust.

Investor Relations: Quarterly Investor Reports / Annual Audited Financial Statements

Please note these outlined returns and distributions are targets only, and the General Partner makes no assurances that the partnership will meet these targets.

This is a shortened summary of the investment offering, and does not contain all details. Please review the Limited Partnership Agreement, Offering Memorandum and Term Sheet (both attached to this offering page) in detail prior to investing.

Bonus Units

| Subscription Amount | Bonus Units (%) |

|---|---|

| $250,000 - $499,999 | 1% |

| $500,000+ | 2% |

Example: $400,000 subscription would be entitled to $4,000 of Bonus Units (1% x $400,000), which will be applied to the Subscriber’s initial investment.

12/07/2022

Investor Update - 12.07.22

Scott McGillivray Real Estate Fund Investor Update

December 7th, 2022

FAQs

How is the Fund structured?

We wanted to create an opportunity that was available to the widest audience, therefore we have created a Trust-LP structure with an Offering Memorandum, which allows us to have Accredited and Non-Accredited investors, as well as allow for investing through Registered Plans (RRSP-TFSA). The trustee is Olympia Trust - the largest in the industry.

How qualified is the management team as a whole?

The Scott McGillivray Real Estate GP team consists of four founding partners with a variety of complimentary skillsets, including real estate, development and asset management expertise. Together they have a combined 50+ years of experience and accreditations that include CPA, CFA and MBA. You can read more about Scott McGillivray, Andrew McGillivray, Dan Pero, and Erik Kroman in our Investment Presentation.

Describe the Fund strategy – will it be more than one project? Where are you investing?

We are focused on creating value (returns) through real estate development, namely residential, low-to-mid rise housing in Southern Ontario. The objective is to invest in 2-3 different residential development projects per fund (diversification) on an equity basis, and provide some balance and yield to the overall portfolio with debt investments, including development loans, mortgages or credit facilities (approx. 15%-20% of the portfolio). We believe there are sustainable and supportive fundamental factors at play, namely in Ontario, including restrictive land-use policies (the Green Belt), and population growth – which will continue to be positive for new housing development.

The management team has discretion over how the capital is invested within the framework set out in the Offering documents. The core focus is residential real estate development – forcing value appreciation through the development process – providing us with a reasonably flexible mandate to maximize opportunities. The strategy for each underlying asset may differ – for example the value proposition for one project may involve a full-cycle development through construction, where another could be a rezoning play with the exit strategy being a sale upon approvals.

Why invest in mortgages at all?

The thinking behind having Mortgages in the portfolio is to provide a monthly income stream (cash flow) for investors that want to utilize financial lending instruments such as a HELOC to invest. We also offer a Distribution Re-Investment Plan (DRIP) for those that want to re-invest the cash flow.

What is the minimum investment?

Minimum investments are between $50K - $100K, with some flexibility, so please ask.

Can I use Registered Funds?

Yes, you can invest using a Registered Account (ie. RRSP & TFSA) through Olympia Trust.

You cannot invest via Registered funds held at another institution, you are required to create an account with Olympia Trust and move the funds there.

There are fees associated with both opening an account with Olympia Trust and transacting. Please review below for full details of fees.

There are multiple scenarios an investor might encounter when considering investing via Registered funds. For simplicity, Equivesto will help you complete all Olympia related forms during the Equivesto signing process of making your investment and submit the forms to Olympia on your behalf.

Please review the below subheading for whichever scenario is the right fit for you:

Existing Account with Olympia Trust:

If you have an existing account with Olympia trust, you can easily transact with the Registered funds already in said account. Simply notify Equivesto via email at support@equivesto.com that you will be transacting with funds in your existing Olympia Trust account, and we can ensure the subscription package you receive when transacting contains the right documents.

NOTE: If you are transacting with funds already inside a registered account, when you reach Step 3 of the Equivesto transaction process (after signing and submitting your documents), Please Stop and do not provide your bank account details.

Existing Account with Olympia Trust, but Transacting with funds that will represent a new contribution to your Registered Account:

This is the simplest method to invest in the Scott McGillivray Fund while also investing via Registered Funds. Since you are investing with funds that will be a new contribution to your registered account, you can simply complete the investment for cash, and the securities themselves can be contributed 'in kind' to your Registered account afterwards.

Simply notify Equivesto via email at support@equivesto.com that you will be transacting with new funds not yet in your existing Olympia Trust account, and we can ensure the subscription package you receive when transacting contains the right documents. Then you can complete the Equivesto transaction process entirely normally.

Opening a New Registered Account with Olympia Trust, and Transfering funds from an existing registered account to Olympia for the transaction:

This process can be the most complicated for making an investment, simply because transfering the funds from your existing institution to Olympia Trust can take up to 8 weeks. Even so, we do evreything we can to make the process easier. Simply notify Equivesto via email at support@equivesto.com that you will be opening a new Olympia Trust account and transfering in funds from an existing registered account. We will ensure the subscription package you receive when transacting contains the right documents.

NOTE: When you reach Step 3 of the Equivesto transaction process (after signing and submitting your documents), Please Stop and do not provide your bank account details.

Fees:

There are several Fees that Olympia Trust changes to investors that use their services. These fees are not charged by Equivesto. To simplify the process, all Olympia fees will be paid via credit card.

Annual Account Fee: $175 per account

Purchase of Security: $75

In Kind Contribution: $100

Document Processing Fee: $25

Example Scenario: Creating a new TFSA account, moving funds from an existing TFSA into the TFSA, and then investing: $175 (annually) + $75 + $25 = $275 one time, $175 ongoing.

What are the expected returns? How can they be so high?

The Target Total Annual Return is 15%-20% - including both the Income and Growth components. The Value appreciation (land + new housing) that can be created through the development cycle (rezoning through construction) can be very attractive. While there are certainly always risks, when done correctly, the margins (and therefore investor returns) have the potential to be substantial.

The income stream (target of 3% per year) is ideally for those who want to utilize financial leverage instruments such as a HELOC to invest. It will allow them to offset the interest costs while putting the bulk of their capital to work on the Equity-side (growth).

The Equity target is 12%-17% per year, while the TARGET TOTAL ANNUAL RETURN is 15%-20% per year (net of fees and expenses)

How do the returns work? When should I expect distributions?

Investors can expect monthly income distributions (the target is 3% per year). You will begin receiving distributions a month and a half after your investment, and monthly thereafter. The bulk of returns and distributions from underlying investments in the development projects (equity) will be returned as the ‘Exit Strategy’ for each project is realized at the end of the Fund Term, which is 3-4 years. We do not plan to re-invest the capital, but rather distribute it out and wind-up the partnership.

Can you tell me about the Term? Can I redeem in two years? What happens after four years?

The Term is 3-4 Years, and will depend on the underlying projects. Our objective is to invest the fund capital in opportunities that meet the fund mandate from a strategy and risk/return perspective, but also the term we have set. Which means the exit strategies for each asset will be assessed with this framework/constraints in mind. For projects beyond four years, the objective would be to have a ‘Successor Fund’ to provide liquidity through a sale or rollover. However, If we needed to extend the LP beyond four years we would go to a special vote by investors.

The LP is a closed-end fund, which means there are no redemption rights. The Trust does have redemption rights, but there is a redemption penalty. The underlying investments for this type of Fund are inherently illiquid, and therefore the fund structure must align with that. Each investor should be aware of the illiquid nature of this fund, and plan accordingly.

Is my money guaranteed? Are there risks?

There are always risks, and there are no guarantees (unless you want GICs or Government paper at 0.5%-1.5%).

The security is in the Collateral (title to the property or mortgage charge), and guarantees for Debt instruments. It is management’s role to ensure security is strong, and properties are not over-leveraged.

In terms of structure:

- At the Fund-Level – Investor Capital is the first to be repaid (Distribution Waterfall).

- For underlying Development Projects - they are typically structured so that the fund has a ‘priority’ of capital repayment and ‘preferred return’ of 8%-10% before the profits are shared with a development partner (if applicable).

What can I expect in terms of communication frequency?

- Ad hoc fund updates, with a quarterly objective

- Monthly distribution statements (emailed)

- Annual Audited Financials, and tax slips

What are the fees? Explain how we are aligned

- Management Fee of 2% per year

- Carried Interest of 20%, above a 6% hurdle rate (per annum)

- Alignment: The General Partners’ own money is invested along-side all investors (same class, no special class of units)

- Alignment: Carried interest – this is far and away the bulk of the General Partners’ compensation, which provides alignment to the success (profitability) at the fund level. We share in the success overall, or we don’t get paid.

How do I invest? What are the next steps?

Investment - The Closing schedule for the Fund is monthly (end of month), which means investors can come into the Fund on a month-end basis (for example, Apr.30th, May 31st, etc.) until such time that we hit our Target Capital raise of ~$12M at which point we will close the Fund to new investments.

Next Steps – For those that want to invest, simply click 'Invest Now' to being the Equivesto investor account creation process. If you already have an account, simply log in and return to the Scott McGillivray Fund page and click the 'Ready to Invest' button to begin your transaction. The transaction is completed 100% online, including document signing and transfering the funds. Click Here for full details on the process.

We operate in a highly regulated environment and have put in place a structure to both meet the Compliance requirements set by the regulators (Ontario Securities Commission) but also to streamline the on-boarding process for investors. We have engaged a Registered Exempt Market Dealer (EMD) to help manage the investment process. The Canadian Securities Regulators mandate private funds like ours to work with an Exempt Market Dealer when raising capital. The EMD completes Due Diligence on our fund to provide confidence to you as an investor, and are they also licensed to provide financial advice to investors around the fund itself and its related risks.