Legacy Mutual Fund

$17,531,010.25

Offering Description

The Epiphany Legacy Investment Mutual Fund Trust acquires pre-existing income-generating residential and commercial properties in smaller, high-growth cities throughout Western Canada—markets experiencing rapid population and economic expansion often overlooked by institutional investors. The Fund targets strong cash flow and long-term capital appreciation through selective acquisitions in cities with proven growth fundamentals, experienced local property management, and value-creation strategies that enhance both rental income and property values.

Investors benefit from the consistent rental income of pre-existing properties, long-term property value growth, and the natural resilience of these emerging communities, all through a fully hands-off investment experience. Legacy: Building wealth for your legacy. Minimum investment: $2,508 for 528 Class A Units. Please feel free to contact us to learn more.

Five Reasons to Invest

- The underlying property business is cash flow positive and generating distributions.

- Target return of 12-15% with an annual yield (payout to investors) of 8.2%.

- Quarterly payouts start the quarter after you invest.

- You are not tied in, you can redeem ( sell ) your investment on a quarterly basis.

- TFSA/RRSP eligible.

How does the business model work?

Legacy Investment combines investor capital with financing from our banking partner Canadian Western Bank to acquire properties that align with our investment criteria and operational framework. The net operating income generated from these properties is distributed quarterly to investors following a comprehensive performance review.

From an operational perspective, Legacy and our property management partners focus on income optimization through strategic rent positioning, cost management, and proactive property maintenance. Our experience demonstrates that well-maintained properties sustain lower vacancy rates, achieve rental income in the top quartile of their respective markets, and generate superior long-term capital appreciation.

This property value appreciation is reflected in Legacy's unit price appreciation over time. Investors can realize this capital gain component when they redeem their units, capturing both the quarterly income distributions and the accumulated property value growth.

Our Growth Strategy

Our growth strategy targets Canada's $20 billion non-core real estate marketplace, which historically offers more accessible entry points, stable fundamentals, and sustainable property valuations compared to higher-cost primary markets such as Vancouver, Calgary, and Edmonton. These secondary markets typically demonstrate favorable rental yield profiles, lower vacancy rates, and enhanced long-term value appreciation potential.

Target markets including Lethbridge, Grand Prairie, Cold Lake, Saskatoon, and Brandon benefit from diversified economic foundations spanning light manufacturing, agriculture, potash, and energy sectors, combined with steady population growth dynamics. These underserved markets present compelling investment opportunities often overlooked by institutional capital.

Our acquisition focus centers on existing commercial and multi-unit residential properties with established operational histories and proven income streams. Market research indicates Western Canada's secondary markets contain over 230,000 rental units currently in operation, predominantly owned by local and regional operators with limited institutional presence.

From a market penetration perspective, capturing 10% of this marketplace would represent approximately 23,000 units with an average valuation of $120,000 per unit, translating to a total addressable market exceeding $2.7 billion in aggregate value.

The Business and 4 Key Properties

The business currently owns 29 properties in Alberta and Saskatchewan worth approximately $91.1 million. The equity held in these properties by the current management team and owners is just over $14 million. Our partner, Canadian Western Bank, finances the remaining amount. The present Loan to Value is 60% for commercial properties and 82% for multi-family properties.

This high level of equity involvement (insider ownership) by the current management team and owners, highlights this groups commitment to the ongoing success of the business and drives alignment between the goals and objectives of management, ownership and investors.

The two diagrams below provide an overview of four properties the business owns and operates.

Business Key Performance Factors

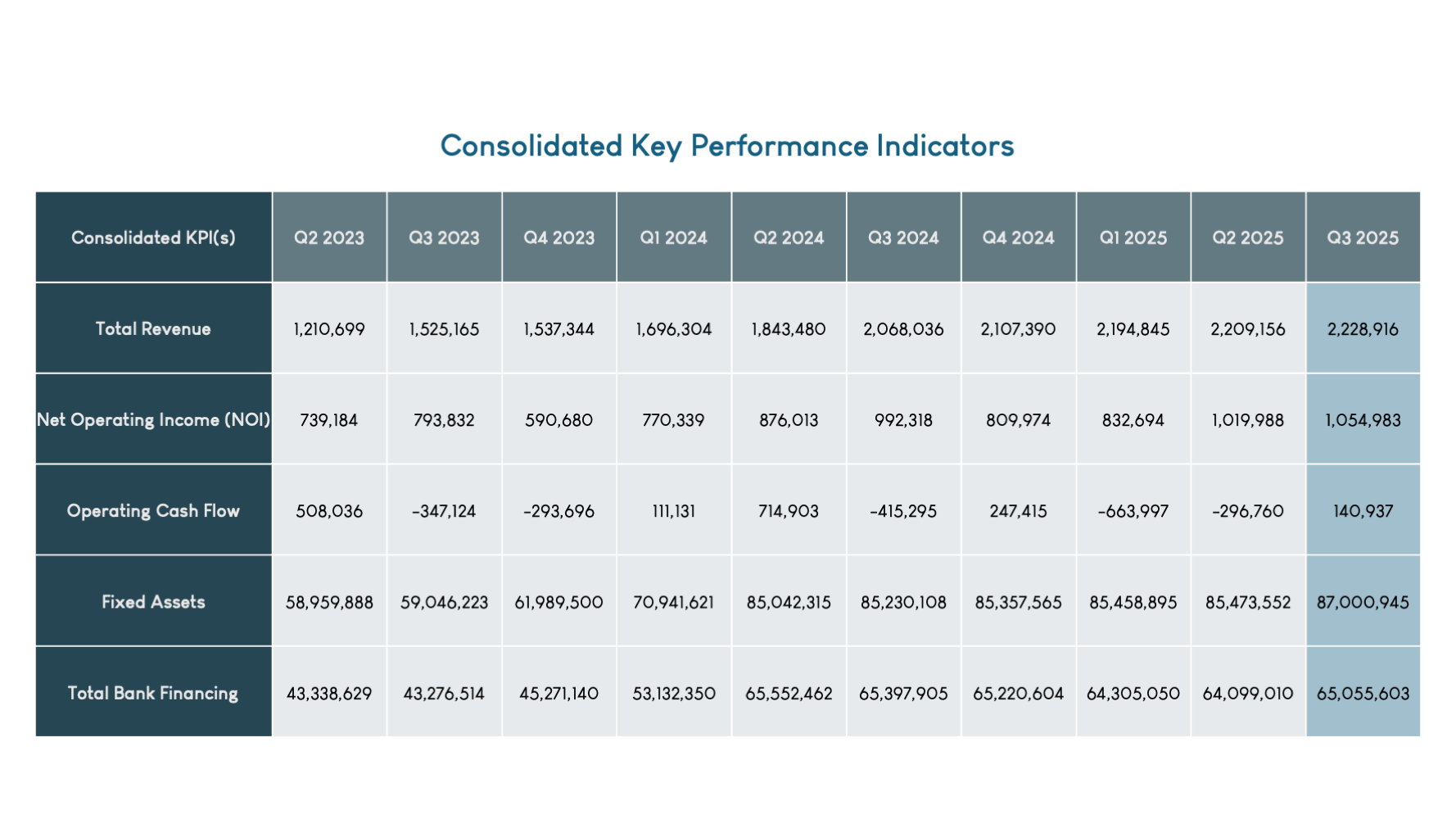

The table below highlights the business’s performance over the past few trailing quarters. Some key observations regarding the business are:

- The business is cash flow positive

- Consistent quarter-over-quarter generation of revenue and net operating income (NOI)

- Consistently generated cash flow to meet debt obligations and support growth opportunities

- Q3 2025 Capacity Utilization:

- Commercial Real Estate – 99%

- Multi-Family Real Estate – 95.3%

Financial Statements are available to investors in two forms

It’s important to the management team and ownership that investors are kept up to date on the progress of the business and business in being operated in professional and transparent manner.

Therefore, financial statements are provided in the two following manners to investors:

- Annually audit financial statements are provided for the entire business, both Limited Partnerships and the Trust

- Quarterly Management prepared financial statements are available upon request

Leadership Team

Offering Terms

Legacy Investment Mutual Fund Trust is raising up to $50,000,000 via Offering Memorandum to acquire residential and commercial properties in Western Canada specifically fixated in the non-core real estate market.

Note: since the business is already operational and cash flow positive, there is no minimum raise amount for this offering.

Targeted Return:

Class A Units: Targeted Return of 12-15% annually

-

The expected annual income is up to 8.2% for Class A Units

-

The minimum investment: $2,508 for 528 Class A Unit

Class F Units: Targeted Return of 14-17% annually

-

The expected annual income is up to 10% for Class F Units

-

The minimum investment: $50,008 for 10,528 Class F Units

Price per Unit:

-

$4.75 per Unit for the next 2,105,263 Units ($10,000,000)

-

$5.00 per Unit for the following 6,000,000 Units ($30,000,000)

Securities offered: Class A Units or Class F Units

TFSA/RRSP Eligible: Equivesto and Legacy Investment have partnered with a 3rd party Trust company to offer this to investors. To hold your investment in a TFSA/RRSP is optional and comes with additional paperwork and an ANNUAL FEE. If you are interested in holding your investment in a TFSA/RRSP, email Equivesto for more details and next steps. Visit our Learning Centre to learn more.

Distributions: Distributions will be paid out quarterly, as income or a return of capital/income when available Legacy Investment offers a Dividend Reinvestment Plan (DRIP), which allows your distributions to be reinvested into the trust on a monthly basis.

If you are interested in participating in the DRIP, please select DRIP when signing your investment forms.

Closings: Legacy Investment Trust will have monthly closings on the 15th of each month, with distributions accruing on the 1st day of the following month.

Redemptions: The Units can be redeemed upon demand after purchase. A redemption fee will apply for Class A Units only (for more details see the Offering Memorandum).

Net Asset Value (NAV): The Net Asset Value of the trust is calculated quarterly in accordance with IFRS Section IAS 40 Investment properties and IFRS 3.

Please refer to our ‘Related Files’ section below, to locate our attached Legacy Investment Term Sheet or Offering Memorandum for further details regarding the terms and conditions of this investment.

This offering is not exclusive to Equivesto, and Legacy Investment Mutual Fund Trust can and will raise capital from other sources and Exempt Market Dealers. The amount raised on Equivesto is not necessarily reflective of the total amount raised by the issuer as part of this Offering Memorandum.

09/25/2022

Residential Real Estate Update Fall 2022

Read More10/16/2022

Offering Memorandum Refresh - October 13, 2022

Legacy Mutual Fund has refreshed its offering document package including the Offering Memorandum, Term Sheet, Investment Summary, and Subscription Agreement.

This refresh ensures these documents remain up to date, and include details of the most recent financial results of the fund.

12/01/2022

Legacy Investment - Residential Properties Q3 2022 Update Webinar

Legacy Investment invites current and future investors to attend our Residential Properties Q3 2022 Update Webinar, on Wednesday, December 14th, at 6PM(EST).

Investors will attend a presentation hosted by:

- Legacy Investments Vice President of Corp. Development - Art Smith; and

- Managing Director Portfolio Management - Riley Dykslag.

Where they will discuss our current property portfolio, upcoming acquisitions, growth strategy and open the floor for questions and answers.

Discover a unique real estate investment designed to provide quarterly income and long-term investment growth.

3 reasons you should be interested in learning more about Legacy Investment:

- How the business operates and achieves a targeted return of 12-17% with an annual yield (payout to investors) of 8.6 – 10.6%;

- How you can maximize the return on investment through the dividend re-investment function and holding the investment in RRSP or TFSA accounts; and

- How your capital is secured and what are your liquidity options.

You do not want to miss out on this opportunity of exploring hands-off investing in the stable secondary real estate market of Western Canada.

RSVP Here

12/14/2022

Legacy Investment - Residential Properties Q3 2022 Update Webinar Recording

Date: December 14, 2022 (6-7pm ET)

Hosted by:

- Legacy Investments Vice President of Corp. Development - Art Smith;

- and Managing Director Portfolio Management - Riley Dykslag.

11/02/2023

Important Updates and Upcoming Webinar from Legacy Investment

We want to thank you for your ongoing interest and support of Legacy Investment.

Upcoming Unit Price and Yield Changes

As of November 1st, Legacy Investment has reached $8.4 million out of its $10 million initial target. Once the $10 million milestone is achieved, the following changes will take effect:

1) The unit price will rise from $4.50 to $4.75.

2) The annual yield will decrease from 8.6% to 8.2%.

The trust will be completing closings during November, December, January, and February. If you are interested in participating prior to the change in price, please contact Alexander Morsink or Ryan Correia at Equivesto.

Notably, investing using registered funds such as RRSP or TFSA is possible. Please reach out to the Equivesto team to learn more about registered investing.

Upcoming Webinar

Legacy Investment is pleased to invite you to an upcoming "Introduction to Real Estate Investing in Western Canada" webinar in collaboration with Equivesto Canada.

---

Webinar Highlights:

- Meet the Legacy Team

- Get your questions answered

- Gain deeper insights into our approach

---

Webinar Details:

Date: November 14th, 2023

Time: 6:00 PM - 7:00 PM (EST)

This open invitation is for anyone interested in Legacy. It's a fantastic opportunity to connect with our team, understand our approach, and discuss the upcoming changes.

Interested in Exploring Legacy’s Offering

For more details, please visit the Legacy Mutual Fund Investment Page. If you have any questions about next steps, don't hesitate to reach out to the knowledgeable Equivesto team:

Alexander Morsink: (647) 371-5586, alexander.morsink@equivesto.com

Ryan Correia: (647) 371-5522, ryan.correia@equivesto.com

Thanks for your continued support, and we look forward to welcoming you to the webinar.

01/17/2024

Important Updates and Upcoming Webinar from Legacy Investment

As of January 1st, 2024, Legacy Investment has reached $9.2 million out of its $10 million initial target. Once the $10 million milestone is achieved, the following changes will take effect:

- The unit price will rise from $4.50 to $4.75.

- The annual yield will decrease from 8.6% to 8.2%.

The trust will be completing closings during January, February and March. If you are interested in participating prior to the change in price, please contact Alexander Morsink or Ryan Correia at Equivesto.

Notably, investing using registered funds such as RRSP or TFSA is possible. Please reach out to the Equivesto team to learn more about registered investing.

Upcoming Webinar:

Date: January 31st 2024

Time: 6:00 PM - 7:00 PM (EST)

Legacy Investment and Equivesto Canada is pleased to invite you to our upcoming webinar, Legacy Investment: Real Estate Investing in Western Canada By Equivesto Canada Inc.

Webinar Highlights:

- Explore self-directed investing in Real Estate.

- Get your questions about Legacy and Equivesto answered.

- Gain deeper insights into Legacy’s strategy and recent acquisitions.

This open invitation is for anyone interested in Legacy and Equivesto. It's a fantastic opportunity to connect with our team, understand our approach, and discuss the upcoming changes.

Interested in Exploring Legacy’s Offering: For more detail, please visit Legacy Mutual Fund Investment Page. If you have any questions about next steps, don't hesitate to reach out to the knowledgeable Equivesto team:

- Alexander Morsink: alexander.morsink@equivesto.com

- Ryan Correia: ryan.correia@equivesto.com

Thank you for your continued support, and we look forward to welcoming you to the webinar.

FAQs

How do I open an account?

Opening an account on Equivesto is an easy process. Head here: https://equivesto.com/investors to learn more about the process. To create an account, go to https://portal.equivesto.com/signup, enter your information and then complete the full application through the link in the email that you will receive. Investing in private companies is regulated, not like buying a book on Amazon, so you will have to answer some specific questions, similar to when opening an account on Questrade or going to the bank to invest in a mutual fund. Your information is secured with bank level security and kept private, and only seen by Equivesto.

Does Equivesto accept investments from foreign investors or Canadians living abroad?

Equivesto is an Exempt Market Dealer in Canada and is for Canadian investors who reside in Ontario, British Columbia, Alberta or Nova Scotia. Equivesto can only accept investment from those who are permanent Canadian residents who reside in the four provinces that we are licensed in. To learn more about investing on Equivesto, please access our learning centre.

How do I get in touch with an Equivesto representative?

You can email Equivesto to reach a representative who will answer any questions about investing or creating an account. Email address: support@equivesto.com.

Who can invest in Legacy?

Anyone who’s primary residence is in B.C., Alberta, Ontario, or Nova Scotia can invest through the Equivesto Portal. Equity crowdfunding democratizes access to investing in private companies, which traditionally has been reserved for high net worth investors. Equivesto, like any financial advisor, will determine how much each individual is allowed to invest safely.

What if I am not an accredited investor?

If you do not qualify as an accredited investor, you are still able to invest as long as you qualify as either a retail or eligible investor. You can learn more about the investor types on Equivesto here.

What income verification documents are acceptable to confirm my accredited status?

To show that you are an accredited investor, you must provide proof of income over $200,000 per year or over $1 million in net financial assets excluding real estate. You can learn more about the documents and requirements to qualify as an accredited investor here.

Which documents do I need to prove my identity?

To register as an investor on Equivesto, you will fill out an application that provides Equivesto with personal information such as your name, date of birth and address. This will allow Equivesto to verify your identity. If there is additional information that is needed, an Equivesto representative will contact you and ask for a Government-issued photo ID, please.

How do I invest?

Once you have created a profile on Equivesto, filled out the full application and your account has been approved by an Equivesto representative, you can invest by accessing the Legacy campaign page at https://portal.equivesto.com/offering/legacymutualfund and clicking Ready to Invest. This will bring you through investment process and require you to provide your banking information to complete the investment. You can learn more about the investing process on Equivesto here.

What am I actually investing in?

As a Mutual Fund we pool investors money to buy assets that individual investors wouldn’t normally have access to purchase. When it comes to Legacy, you are investing in the Trust's real estate assets. You can learn more about the investment opportunity by viewing the campaign page here.

How much can I invest?

Equivesto will let you know your maximum investment limit based on your investor type. You can then determine how much you want to invest from a minimum of $500 up to your maximum investment limit. You can learn more about investment limits on Equivesto here.

How can I fund my investment?

To invest on Equivesto, you will need to provide your banking information including your bank account number, transit number and institution number. If you would like to make your investment RRSP or TFSA eligible, you will need to be investing over $2,500. If you would like to invest over $2,500 and make your investment RRSP or TFSA eligible please contact an Equivesto representative at alexander.morsink@equivesto.com. There are fees related to investing via TFSA/RRSP, but no fees for investing directly.

Where can I find all the documentation for the investment offering?

All the documentation for investing can be found on the campaign page at https://portal.equivesto.com/offering/legacymutualfund. You can always speak with a representative if you need more information by contacting support@equivesto.com.

What else do I need to know about this investment?

Please review the campaign page at https://portal.equivesto.com/offering/legacymutualfund and the Offering Memorandum which is attached to the campaign page for all of the information about this investment opportunity. Investors are only able to see attached documents, like the offering memorandum after they have started creating an account. Your account does not need to be approved to see the attached documents.

What is the Trust's target yield?

The first tranche of Class A Units has an annual yield of up to 8.6%, with a total target annual return of 12% to 15%.

The first tranche of Class F Units has an annual yield of up to 10.6%, with a total target annual return of 14% to 17%.

How do I get liquidity?

You can cash in anytime after the first year and you will be paid quarterly dividends.

What is a Distribution Reinvestment Plan (DRIP)?

A DRIP is a program that allows investors to reinvest their cash dividends into additional shares or fractional shares of the underlying stock on the dividend payment date.

I am looking for my money to grow, what should I consider?

The Trust offers good returns for those looking to grow their investments or savings, despite being higher risk. You can choose to reinvest your dividends to benefit from compounding on your investment.

I am looking for an income from my principal. What should I consider?

The Trust offers quarterly dividends that you will receive to provide income whilst maintaining your principal. Consider what level of income you are seeking, and based on the estimated returns, you can plan the level of investment you require. When signing your investment documents during the transaction process, you can choose the type of income you would like to receive from a tax perspective. If you have a question about this, please contact support@equivesto.com

What are the fees and ongoing expenses associated with this fund?

There are no fees to invest on Equivesto and purchase units in this Mutual Fund. There may be fees relating to TFSA, RRSP and DRIP. Please contact Equivesto about these additional fees at support@equivesto.com.

What are the risks of investing in the fund?

The risks relating to this fund are similar to direct investing in property, such as decreased value in properties, greater unoccupancy rate and increased cost for property maintenance. The management has attempted to mitigate these issues by having a diverse portfolio of properties from location and type. By having an effective management model for managing property maintenance costs, reducing tenant churn, and maintaining property value increase. There are many risks beyond these, please refer to item 8 of the offering memorandum which is attached on the campaign page at https://portal.equivesto.com/offering/legacymutualfund.

How will I get updates on the fund, and how frequently?

You will receive quarterly updates on the performance of the Trust via email.

How can I invest through my RRSP or TFSA?

Investments over $2,500 are eligible for TFSA and RRSP. Equivesto works with Western Pacific Trust and Olympia Trust to set up the RRSP/TFSA investment. Please contact Equivesto at alexander.morsink@equivesto.com if you are interested in investing through an RRSP or TFSA. There are fees associated with investing via TFSA/RRSP. There is a one time transaction fee of $75, and an annual account fee of $145. If you already have an account with Western Pacific or Olympia Trust, you will not need to pay the annual fee again.

Can I invest with an entity or just as an individual?

You can invest as an entity as long as you can provide all legal documents requested by Equivesto. To do so, when signing up, please choose I am a company on the first page of the investor application form.

What compliance has been done on Equivesto and Epiphany?

Equivesto is governed by the Securities Commissions in each province that they are licensed in and is registered as an Exempt Market Dealer. You can view our registration at https://www.securities-administrators.ca/registration/are-they-registered/#check-registration. Epiphany (The Trust) has gone through the compliance and due diligence process that Equivesto requires and follows legislative parameters. Visit our learning centre to learn more about the checks Equivesto does on companies.

What is Equivesto's due diligence process?

As an Exempt Market Dealer, Eqiuvesto completes thorough due diligence on the issuer, the company documents and all key team members. Equivesto still suggests that you do your own due diligence before investing by reviewing the offering memorandum, reviewing the campaign page and by completing your own research. As part of our due diligence, Equivesto completes full background checks on the company, as well as verifying the statements they are making as part of their offering. For example, if A founder says they have a law degree, Equivesto has to verify that they do have a law degree for them to be able to make that statement on the campaign page.

How can I redeem my investment?

Anytime after the first year. Please request directly through Equivesto.

How does Equivesto get paid?

Equivesto doesn’t charge any fees to investors and gets 7% of the total amount raised by the Trust. The Trust pays Equivesto directly, as an investor you do not have to pay any fees to invest.

How does Epiphany get paid?

By the Trust increasing in value and rents outpacing expenses monthly.

How often will I receive payments?

Quarterly dividends.

In regards to the redemption fee, where is is deducted from?

That’s a great question

The redemption fee starts at 9% in year one, as each year passes the fee reduces, until its eventually zero. The progression is as follows:

- Year 1 – 9%, Year 2 – 7%, Year 3 – 5%, Year 4 – 3% and Year 5 and after – 0%

For example – if you purchased 1000 Class A units at $4.50 for $4500.

If you redeemed the Class A units in year 2 ( 7% ) the outcome would be:

Redemption fee calculation: ( 1000 Class A Units x $5 redemption price ) = $5000 x 7% = $350

Redemption value = $5000 ( 1000 Class A Units x $5 redemption price ) - $350 ( redemption fee ) = $4650

How does inflation and interest rates impact the business?

To mitigate the impact of inflation and interest rate fluctuations the following 3 strategies were imbedded in the design of the business.

Commercial Properties - operating cost, inflation, and the revenue model.

- The business utilizes “triple net leases” to ensure the operating costs of the property, including utilities, property taxes, etc… are passed onto the tenant.

- The only cost not passed on directly is the financing cost of the property.

- This approach ensures the tenant absorbs all the operating cost increases resulting from inflation.

- With respect to revenue for our commercial leases typical timeframe is 3 years or less.

- This approach allows those additional costs, property tax and financing to be offset by rental increases in a relatively short timeframe.

Residential Properties - operating cost, inflation, and the revenue model.

- The business utilizes a standard lease agreement to ensure the majority of operating costs of the property, including utilities, are passed onto the tenant.

- The only costs not covered by the tenant are property cost and financing cost of the property.

- This approach ensures the tenant absorbs all the operating cost increases resulting from inflation.

- With respect to tenant lease agreements our timeframe is 1 year. After the 1 year, the lease moves to month to month.

- This approach allows those additional costs, property tax and financing to be offset by rental increases in a relatively short timeframe.

Financing Costs and mitigating the impact of increasing interest rates.

- The business utilizes a combination of long-term debt and a line of credit to finance the properties in an efficient and effective manner.

- The long-term debt portion provides the business with level of certainty regarding interest rates of a given time period.

- If the term of the term of the long-term debt is greater than the renewal cycle on the properties lease then the impact of interest rate increases is fully mitigated.

The three strategies above when executed efficiently, mitigates the impact of inflation and interest rate fluctuations on the core business and thus the investor and their investment.